The innate desire for beauty lies within everyone, some stronger than others, and China in this case has displayed an unrivalled consumption level in the medical aesthetic industry in the name of beauty.

According to the Deloitte Medical Cosmetology Marketing Report, the Chinese medical aesthetic industry has scale up to 870 billion yuan in 2015, 1250 billion Yuan in 2016, 1760 billion Yuan in 2017, estimated up to 4640 billion Yuan in 2020 with an annual compound growth rate up to 40% surpassing Brazil, becoming the second largest medical aesthetic industry world-wide, with United States coming first.

In the 2017 medical aesthetic industry white book stated, in every 2.5 consumer, there is 1 Chinese consumer, internationally.

The Rapid Growth of Medical Aesthetic in China

1. Rapid Growth of the Economy

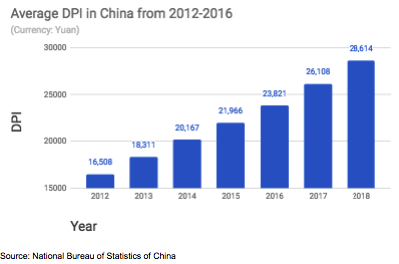

One of the contributing reasons behind the rapid growth of medical aesthetic in China is due to the changes to the economy, influencing average income and disposable personal income (DPI).

With the development of the economy, the average DPI of the population in China started from 16,000 in 2012 to 26,000 in 2017, an annual compound growth rate increase by 9.7%.

Another reason is the population structural changes of the old-age population. Analyzing the current population of 14 billion people in China by a world population research group, 23.3% of the population is estimated to be part of old-age group, which is expected to stimulate the development of the industry even further.

2. Consumer Habits and Knowledge

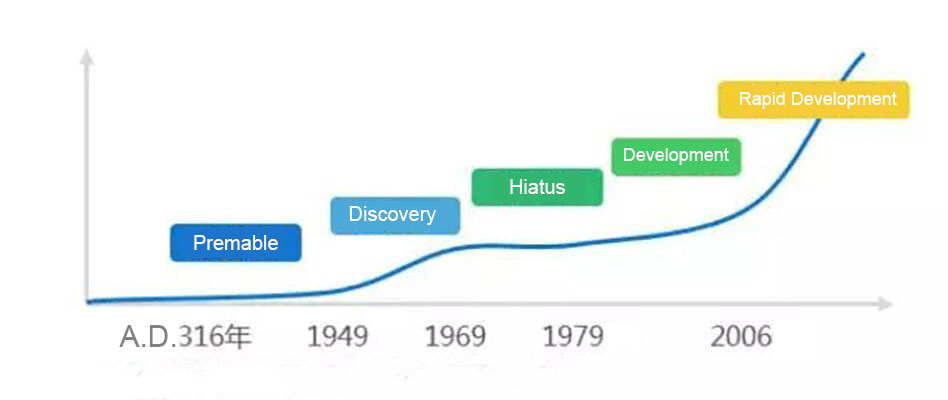

The history of medical aesthetics traces back to B.C 316, when the first cleft lip and palate surgery was performed. Later in 1934, the first plastic surgery clinic was established in Shanghai. The demands for plastic surgeries have escalated after the period of Korean War with surge of wounded clients, encouraging development in the cosmetic surgery field. However, with the movement of Cultural Revolution in China, have put a development interlude until the Chinese economic reformation.

And with the current rapid development in medical aesthetics in 21st century, demands from the population are soaring as people become more susceptible to the idea of it.

Some of the reasons why the population has quickly become accustomed to medical aesthetic is due to the cultural changes and public figures, like celebrities. As the structure of Asians tend to be less prominent compared to other races, medical aesthetics and procedures, achieving what was not biologically given.

Those born in the 1980’s and 1990’s called “Generation X” and the “Millennial” have become the main target audience and consumers, as the both groups are more open-minded, susceptible to innovative ideas and changes. With the influence of social media, the importance on physical appearance has been imbedded into the consumers’ values.

Especially since the arrival of 21st century, medical aesthetic have shifted from “want” to need”, as a means to gain confidence, be celebrity-like, meet social appearance standards and such.

Present State of the Medical Aesthetic Industry in China

1. Dominant Age Group

In 2017, the total amount of people subscribed to medical aesthetics have accounted for over 267 million people, an increase of 13.57% from 2016.

Within the consumer for medical aesthetics, females account for 79% of the market, creating a 1:4 ratio between male and female. However, the potential of the male consumers should not be unrecognized, as data have shown an apparent increase in generation x male consumers.

According to research in the medical aesthetics, consumers under the age 28 have shown the highest level of consumptions in comparison to other age groups. Additionally, comparing data from 2016, generation x consumers have increased by 3.11% and millennial consume 14.36% of the market, growth rate of 4%.

2. Strict Legal Procedural Rights for Cosmetic Surgeries

The requirements for careers in medical aesthetic lean to a lower end, medical practitioner license as the only essential fulfillment, with relatively limited restrictions, creating a great deal of issues on license regulations and illegal managements. When consumers are faced with unsuited cosmetic clinics due to lack of information and specification of this industry, causing potential over-diagnoses or loss of potential clients.

In contrast with the acceleration of the industry, there is clearly not enough restrictions on the procedural rights for clinics, but there are also limited certified medical practitioner to meet the demands of the market

Since 2016, the government has made changes to the regulations and restrictions to manage illegal medical aesthetic practices, to improve quality of services. At the same time, the government has allowed practitioners to equip additional certifications at the same time to meet the demands.

3. Marketing Expenses

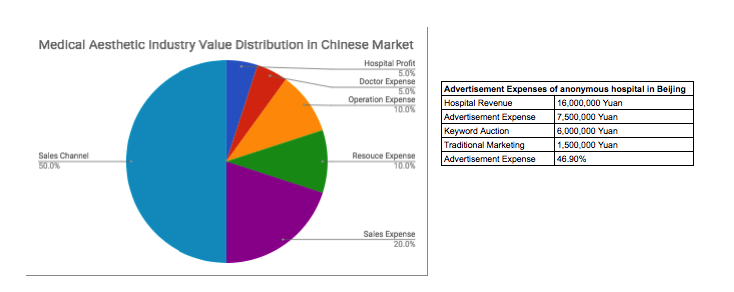

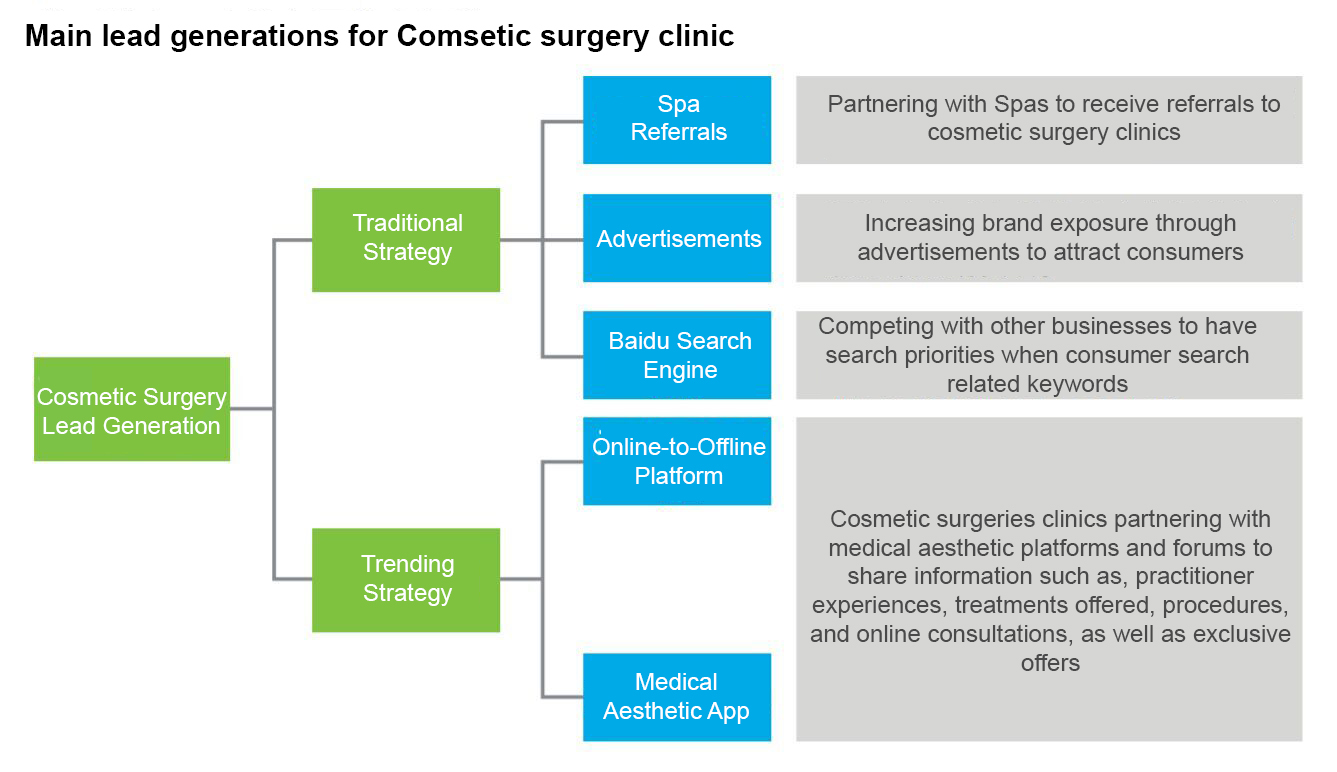

In comparison with the States and Korea, the medical aesthetics in China can be considered as under-developed, and highly reliant on advertisements and lead generations.

The sales channels provide results, but interconnected with the increase in expenses (averaging 6000 – 7000 yuan per client). As return rate with the clients are low, businesses have to continue to advertise to bring in more clients.

While traditional sales channel provide apparent results, the cost of acquisition (CAC) is high, averaging 6000-7000 yuan. But acquisition and repurchase rate remains low, thus the constant expenses towards marketing distresses most businesses.

With the assistance of guerilla marketing, 50% of the revenue is invoiced to sales channels and marketing agencies causing medical aesthetic businesses to sustain on break-even point, contributing to the overpriced treatments and procedures.

Especially with the incidence of Zexi Wei, digital advertising has fallen into crisis, as Baidu, which is the search engine involved in the incident have announced a new set of audit restrictions on medical advertisements. Later influencing Tencent social advertisements, increasing expenses by a margin.

4. Adaption of digital platform

Following the rapid development of the real-time communication, medical aesthetics apps and platform have provided businesses with a new sales channel. Presently, 80% of medical aesthetics businesses have reduced search engine advertisements, and 30% of these businesses expressed interest in medical aesthetics apps as the main lead generation.

Since 2014, Gengmei, as the leading representative for most medical aesthetic app in the market, is providing consumers with the generalized 4-in-1 platform, for community, clinics, reviews, and services.

With the reformation of lead generation, the business model of the medical aesthetics reconstructed to provide safe and suitable services, allowing consumers to be more susceptible to medical aesthetics.

All in all, online platforms are used as a reference and lead generation only, in-person customer services and experience remain as the crucial obstacle for sales and conversions.

How to Penetrate the Chinese Market as an Oversea Medical Aesthetic Equipment Manufacturer

1. Entering Through Medical Aesthetics Businesses

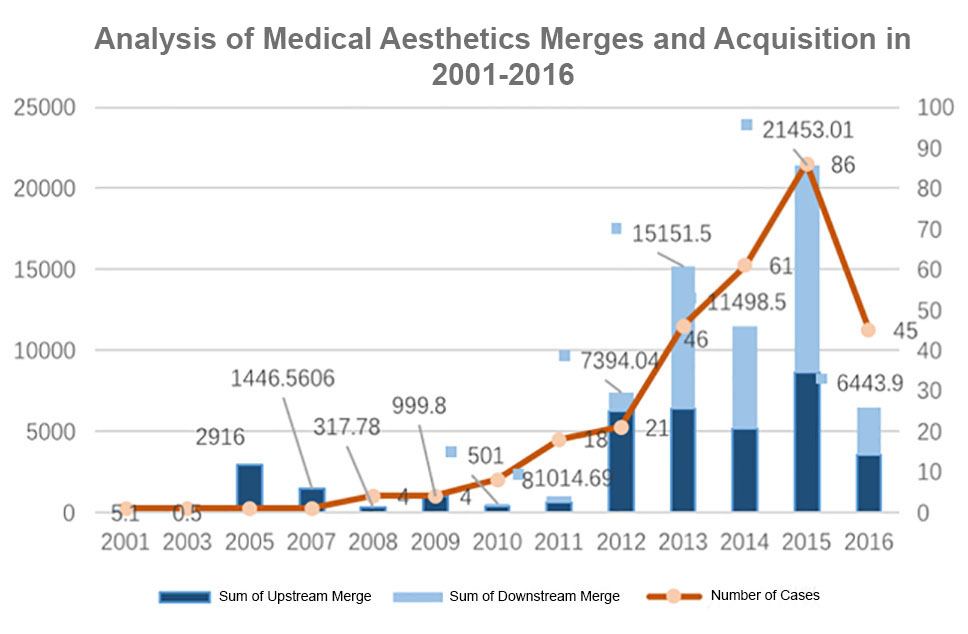

Seeing the potentials in the Chinese market, a trend of mergers and acquisitions targeting listed businesses have initiated, for the purpose of introducing new technology and products.

Up until 2017, there are 22 medical aesthetic corporations listed corporations, including Suning, Lancy, CHJ Jewellery, acquiring medical aesthetic businesses to consume Chinese market.

In the recent years, other medical aesthetic brands from oversea began contesting for a spot in the Chinese market as well.

In 2003, the world re-owned laser manufacturers, Alma Lasers entered the Chinese market. Their products range from age prevention, pigmentation, hair removal, skin treatments, and post-recovery as the five specialties. The Chinese market account for 25% of their business revenue, while their products account for 30-40% of the laser treatment technologies in China.

International hyaluronic acid injectable related brands such as Galderma, Filorga, Pricess, and others foresee a great potential in the Chinese medical aesthetic market

In the current state of the Chinese medical aesthetic industry, calculating the number of franchise, only six businesses have over 10 franchises, and only one business with a revenue of over 1 billion – Union Medical Healthcare. However, there remains countless potential and opportunities for development in the Chinese medical aesthetics, waiting for other businesses to expand and grow.

Investors interested in franchises can consider building upon brand reputation and image first before moving forward with brand specialty. Similarly to South Korea, in the medical aesthetic field, there is a clear difference between each clinics, medical practitioners are specialized in specific treatments, which provides clients confidence to deliver safe and experienced treatments.

2. Obtaining legal rights

In the medical aesthetic field, USFDA, CE, and CFDA are the three most influential and trusted regulatory agency.

Regardless of the origins and regions, all medical technology, treatments, and services must be approved by the CFDA to legally provide to consumers in the Chinese market.

Using Picosure, developed by Cynosure, as an example, it is the world’s first picosecond technology approved from the three regulatory agency, and the only picosecond laser technology in the Chinese market, known as the “Rolls-royce” of the laser technology.

In 2015 after entering the Chinese market, the technology has quickly become a favourite of the consumers under the influence of a Chinese celebrity, Bingbing Fan, its one-of-a-kind effect and results.

Another example is Botulinum Toxin or Botox from the States is the only CFDA approved Botox type product in China, while the other one approved is Hang Zhou BTXA from China.

In comparison, Ultherapy, treatment developed by the world’s top medical aesthetic technology company, known as Ulthera. Ultherapy is approved by USFDA, CE, 63 countries in Europe and America, but still in application process for approval for CFDA.

Before applying for the CFDA approval, an understanding to the process is essential, such as type of documents, clinical treatment record, and professional clinical data needed, time, and any details to faster obtain the approval.

However, another option to be time and work efficient, there are experienced third-party companies in the market, to complete the process in the company’s stance.

In conclusion, for any medical aesthetic technology to expand and grow in the China, a CFDA approval is a necessity.

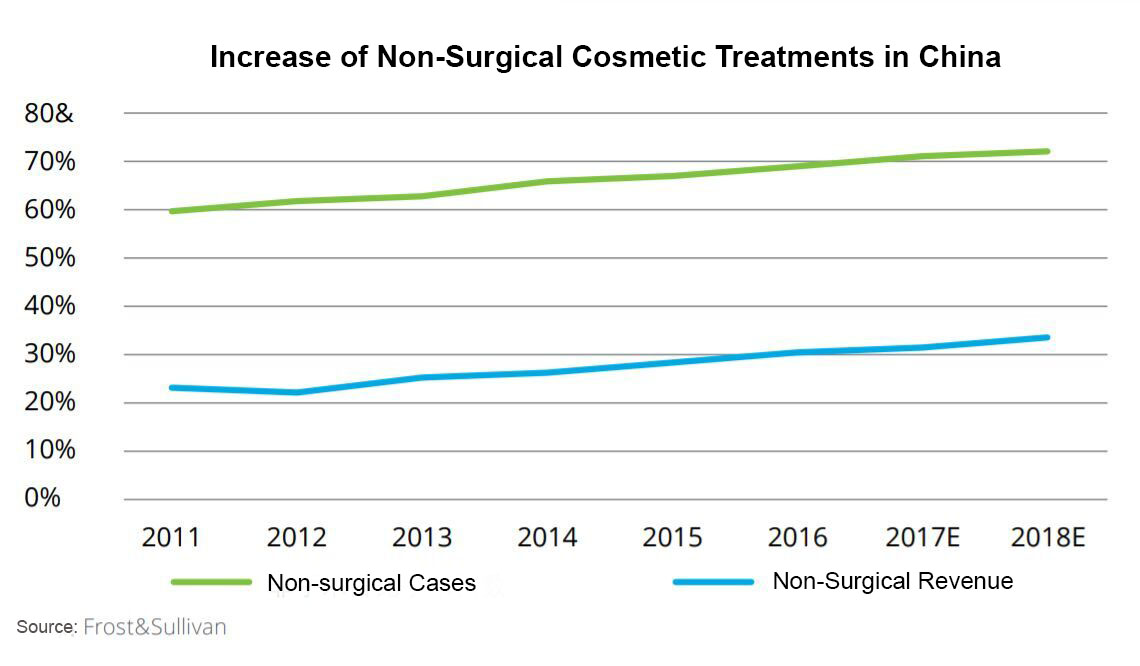

3. Micro-cosmetic surgery procedures

Micro-cosmetic surgery is the current focus in the Chinese medical aesthetic industry, accounted for 60% of income within the industry, growth rate up to 40%. Non-surgical cosmetic procedure is expected to reach 73.5% in 2019.

In contrast to traditional cosmetic surgeries, micro-cosmetic surgeries such as, botox injections and injectable fillers, where there is no down time and much more affordable is definitely more susceptible to consumers to obtain trust.

Non-surgical cosmetic treatments, such as injectable fillers, botox injections, and skin treatments are to become the trending services in the industry

Using injectable filler as an example, there are currently 16 brands with CFDA approval, including Juverderm, which accounts for 21.83% usage, Yviore, accounting for 13.93%. In the selection Chinese injectable filler brands, Matrifill as one of the highly recognized filler by domestic manufacturer in China, account for 16.81% of the market.

Looking at the current state, imported brands occupy a wide range of the Chinese medical aesthetic industry, when exlucded, there is a lack of selection for consumers, and the market is far from being developed, thus investors can consider entering the market through micro-cosmetic surgery

4. Audience analysis

In the States, the main consumer group is ranged from age 35 and older, accumulate 80%, and penetrate 13% of the market. In China, the consumer group from age 35 and older consumes 12%, and penetrates only 0.2% of the Chinese market.

In long-term, consumers from age 35 and older are much more financially independent and stable, with higher DPI. However, the demands for medical aesthetics for this age group are lacking, but a spike in revenue is expected when interest is provoked and medical aesthetics is more culturally accepted.

With the development of the cyberspace, people are now given the option do to order and do many things over the web, bringing in a surge of income from the “homebodies”. With the lack of outdoor activities and health maintenance, consumers are much attracted to health-related products, serving its popularity.

Using skin care equipment as an example, in March 8th 2017, the “Queen’s day” to celebrate women, the sales of skin care equipment have outperformed robot vacuums. In November 11, 2017, the revenue of skin care equipment have skyrocketed 3 times it’s sales within an hour.

Although there are brands like Clarisonic, Foreo, ReFa, Ya-Man, the market is far from developed, and these brands are merely experiencing spikes in revenue. Thus, the general manager of beauty products from TMall, Wan Gu, predicts that beauty products can grow 5 to 10 times its current market in time.

Presently, with the amount of stressors, males are beginning to pay attention to treatments like hair transplant, fat-reduction, skin maintenance, and this can also be a new business opportunity to promote treatments and products suitable for male consumers.

5. Consumer attraction and context

Several years ago, televisions, newspaper, and postings are all the possible sales channel, businesses with the most exposure on these channels dominate the industry, but with the development of social platforms arising, traditional advertisements have been overpowered by digital advertisements. Especially within the last two years, using Wechat as a sales channel have skyrocketed the medical aesthetics industry. Aside from bringing more views to the platform such as Gengmei, content of the platform is also crucial, details of products and services also needs to be advertised.

For example, So Young is a medical aesthetic mobile software using celebrity as an attraction, where consumers are able to obtain comprehensive information on the current beauty trends and new technology. In 2017, So Young have obtained 3.8 billion views, 1.2 billion interactions, additional 5.5 billion views on short videos, ranking as the 22nd in China’s top most followers of official accounts out of 200 million official accounts, becoming China’s top corporate official account, completing D-2 financial series for 2 billion dollars in Yuan.

Looking at the current trends of media, short videos will be the main sales channel for medical aesthetics in 2018

Conclusion

It is undeniable fact is that the Chinese market for medical aesthetics is undeveloped in comparison. Fortunately, there remains space for expansion. And with the steady development of the economy and consumers, the market exist numerous hidden business opportunities and potentials for everyone.

Keep yourself on top of what's happening in China

Studies, guides, news and other digest of China delivered right to your inbox.

No Charge. Unsubscribe anytime.